Today, JIKE will talk about the most common solution for freight risks—freight forwarder insurance. So, what risks might we encounter during the transportation of goods? Natural disasters, traffic accidents, theft, loading and unloading of goods, and non-delivery. Are these common risks in freight transportation that everyone occasionally encounters? Below, we will introduce the coverage of freight forwarder insurance and when you might need it.

What Is Freight Forwarder Insurance?

Freight forwarder insurance, also known as freight forwarder liability insurance, is a type of insurance coverage designed to protect freight forwarders and logistics service providers from potential financial losses and liabilities arising from the transportation and handling of goods on behalf of their clients.

Freight forwarders play a crucial role in the shipping and transportation industry by organizing and coordinating the movement of goods from the point of origin to the final destination. During this process, various risks and uncertainties may arise, such as damage, loss, theft, or other incidents that could result in financial losses for the parties involved. Suppose buyers outsource their products' transportation to a professional carrier or freight forwarder. In that case, they might expect the carrier or freight forwarder to bear complete responsibility for any damage or loss in shipping. However, carriers and freight forwarders only assume limited liability. Without freight forwarder insurance, freight forwarders might face significant cost loss and be under tremendous pressure from buyers. Hence, freight forwarder insurance was designed to help safeguard freight forwarders' finances when the unexpected happens.

That's why it's important to understand the general principles, the most common risks associated with transporting goods, and when to arrange freight forwarder insurance.

Cooperate With A Reliable Chinese Freight Forwarder.

Four Aspects Covered By Freight Forwarder Insurance

Freight forwarder insurance typically covers the following aspects:

Cargo Insurance

This component covers the value of the goods being transported against loss or damage during transit. It provides compensation to the freight forwarder or their client in the event of specified perils, such as accidents, theft, or natural disasters.

Liability Insurance

Freight forwarders may be exposed to liability risks, including errors in documentation, improper handling of goods, or delays in delivery. Liability insurance helps protect the freight forwarder from legal and financial consequences in case they are held responsible for such issues.

Errors and Omissions Insurance

This type of coverage is designed to protect the freight forwarder against claims resulting from errors or omissions in their professional services. It can include coverage for mistakes in documentation, incorrect shipping instructions, or other oversights that may lead to financial losses for the client.

General Liability Insurance

This provides coverage for third-party bodily injury or property damage claims that may occur during the transportation process. It helps protect the freight forwarder in case of accidents or incidents that result in harm to individuals or property.

It's important for freight forwarders to carefully assess their specific needs and risks and choose insurance coverage that aligns with their operations. Insurance requirements may vary based on factors such as the types of goods handled, the transportation modes used, and the destinations involved in the logistics process.

When You Should Buy Freight Forwarder Insurance?

Freight forwarders should consider purchasing insurance coverage as soon as they begin providing logistics and transportation services for their clients. Here are some key considerations for determining when to buy freight forwarder insurance:

Commencement of Operations

As soon as a freight forwarder starts handling shipments on behalf of clients, they are exposed to various risks associated with the transportation and logistics industry. Insurance coverage should be in place from the outset to mitigate potential financial losses.

Client Requirements

Many clients and business partners may require proof of insurance coverage before entering into contracts or agreements with a freight forwarder. Having insurance in place can enhance the credibility of the freight forwarder and demonstrate a commitment to risk management.

Legal and Regulatory Compliance

In some jurisdictions, there may be legal or regulatory requirements mandating that freight forwarders carry certain types of insurance. It's essential to be aware of and comply with any such requirements to avoid legal consequences and to operate responsibly within the industry.

Risk Assessment

Freight forwarders should conduct a thorough risk assessment to identify potential hazards and liabilities associated with their operations. This assessment should consider factors such as the types of goods handled, transportation modes used, routes taken, and the potential for errors or delays. Based on this assessment, appropriate insurance coverage can be selected.

Contractual Obligations

When entering into contracts with clients, suppliers, or carriers, it is common for agreements to include insurance requirements. Freight forwarders should carefully review contract terms and conditions to understand any insurance-related obligations and ensure that they have the necessary coverage in place.

Expansion of Services or Operations

If a freight forwarder expands its services, enters new markets, or increases the volume and value of shipments, the business's risk profile may change. In such cases, it's essential to reassess insurance needs and adjust coverage accordingly to protect against new or heightened risks adequately.

Changes in Regulations or Industry Standards

Insurance requirements and industry standards may evolve over time. Freight forwarders should stay informed about changes in regulations and best practices within the logistics industry and adjust their insurance coverage accordingly.

Jike, as an experienced freight forwarder in China, we suggest our fraternity work with insurance professionals specializing in transportation and logistics to tailor coverage to your needs. Regular reviews of insurance policies are also important to ensure that coverage remains adequate as the business evolves.

International Trade Terms and Responsibilities

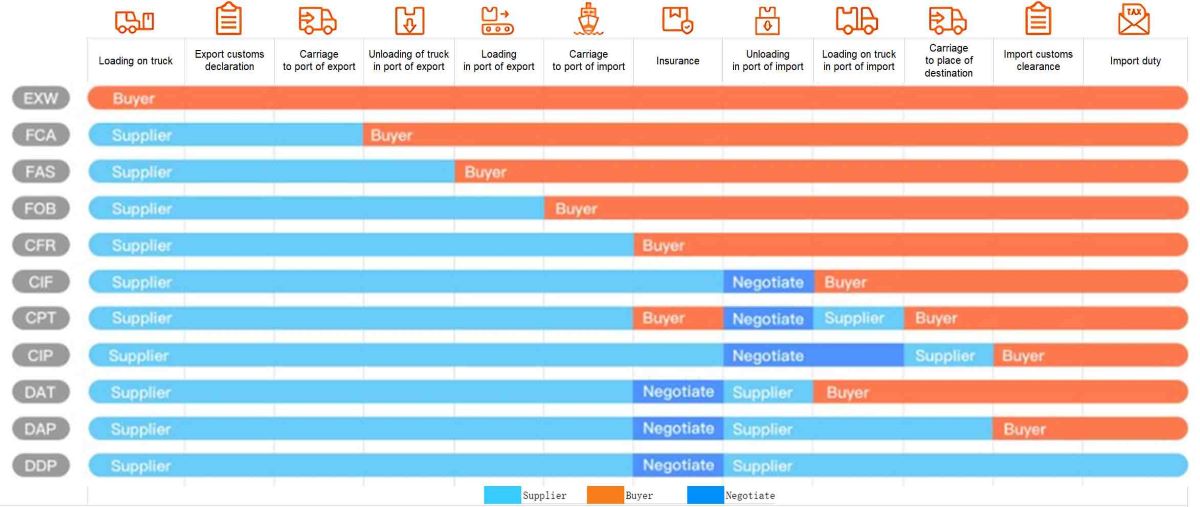

For freight forwarders, international trade term rules define the rights and obligations between the buyer and seller for transportation and delivery services. International trade term rules clarify who pays for what. They also specify who is responsible when any damage or loss of goods occurs during transportation.

In most cases, Carriers or freight forwarders are only responsible for damages or losses caused by obvious errors or negligence during transportation. Similarly, the scope of responsibility of carriers or freight forwarders and the maximum compensation they need to pay are also limited.

For the buyer: Please pay attention to the insurance part in the above photo. As a buyer, you should note that in these terms, you need to cover insurance for your shipments: EXW, FCA, FAS, FOB, CFR, and CPT terms. This also means if you let a freight forwarder handle your cargo, you can remind freight forwarder insurance to protect your goods from risks. And in the CIF and CIP terms, the seller should be responsible for buying the insurance for you. Please note that there is no obscure instruction regarding the insurance in DAT, DAP, and DDP terms, so you should negotiate with the seller about who should take the Insurance part.

Tips for Freight Forwarder Insurance

If the value of your consigned goods exceeds the maximum amount your carrier or freight agent is liable for, it is wise to inquire about freight forwarder insurance.

Freight forwarder insurance ensures that, in the event of issues during transportation, you will be compensated based on the commercial invoice value of the goods. If there is no commercial invoice, the amount is determined by market value, and transportation costs might be reimbursed.

If you are a shipper, you are responsible for arranging insurance if needed. The level of insurance premium depends on several factors, including:

Value and nature of the goods

Destination

The chosen mode of transportation

Knowledge Supplement for Freight Forwarder Insurance -Advanced

Risks and Measures

Common risks associated with transporting goods include damage, loss, or theft.

Damage: This includes goods that are scratched, dented, or damp during transportation. Shippers are responsible for ensuring proper packaging. If the goods are damaged or improperly packaged when received by the carrier, this will be noted on the transportation documents. In the case of air or sea transportation, if the consignee receives goods with evident damage, the carrier directly assumes responsibility. For road transportation, noting it on the transport document is sufficient. In all cases, written notice must be given immediately. If the damage is not immediately visible, for air or sea transportation, the carrier must be notified within three working days, and for road transportation, within seven working days. Even if the goods are damaged, they are usually delivered to the consignee unless further transportation is meaningless or impossible.

Loss or Theft: This includes partial or complete loss of goods or obvious theft. In this case, proving that the loss or theft occurred while transporting goods is crucial. In principle, losses should be noted on the transport documents, listing the content and quantity of the goods. The carrier signs the transport document upon receiving the goods. If the consignee discovers the loss upon receiving the goods and notes it on the transportation documents, it serves as evidence that the loss occurred during transportation. Theft must be reported to the police every time, and responsibility lies with the party possessing the goods at the time of theft. If there is no evidence of theft, the incident will be considered a loss of goods. In the case of partial loss or theft, the affected party is compensated proportionally. The carrier assumes direct responsibility for lost or stolen goods for air or sea transportation. For road transportation, an explanation of the transportation agreement is sufficient.

Freight Delay: A delay in delivery can sometimes lead to economic losses, known as "consequential loss" or "special loss." Carriers and freight agents rarely bear responsibility for such losses. If it can be proven as an error or negligence, they may be required to reimburse the already paid freight charges at most. Insurance for consequential losses is typically impossible because it is challenging to quantify the exact extent of such losses and estimate the associated risk level.

General Average (Limited to Sea Transportation): Although not frequent, it is important to note. The general average refers to common damage to the ship and its cargo. If the ship is in danger, sacrifices may need to be made to protect the safety of the ship, crew, and cargo. All costs associated with salvage operations, including the value of any sacrificed cargo, are shared proportionally by the shipowner and cargo owner. In practice, sea freight shippers bear a portion of the costs. However, insurance can be obtained for such risks.

Special Risks for Common Goods

| Grain and Edible Oils | Bulk Grains (cereals, grains, etc.) | Shortage, Mold |

| Edible Oils (cooking oil, palm oil, etc.) | Shortage, Contamination | |

| Fresh Produce (flowers, fruits, vegetables, etc.) | Decay, Spoilage | |

| Live Animals (livestock, live animals, etc.) | Disease, Death | |

| Light Industrial Goods | Glass, Ceramics, Enamelware | Collision damage, chipping, theft, breakage |

| Handicrafts | Breakage, theft | |

| Precious Metals and Jewelry | Theft, Non-delivery | |

| Hardware and Minerals | Metal and Steel | Rust damage, underloading, sinking |

| Mineral Sands | Underloading, sinking, collision of transport tools, contamination | |

| Coal, Cement | Flammable, Pollution, Clumping, Sinking | |

| Chemical Products | Solid Chemicals | Flammable, Pollution, Underloading, Hygroscopic |

| Liquid Chemicals | Flammable, Volatile, Shortage | |

| Gaseous Chemicals | Flammable, Explosive | |

| Feed and Livestock Products | Fishmeal, etc. | Shortage, Mold, Moisture, Clumping, Spontaneous Combustion |

| Machinery and Equipment | Power Equipment, Oversized and Overweight Items | Collision damage |

| Transport Vehicles | Prone to damage, dents, scratches | |

| Precision Instruments (equipment for chip or LCD manufacturing, etc.) | Shock, Collision, Breakage, or Damaged Packaging | |

| Communication Equipment (phones, computers, etc.) | Prone to theft, non-delivery | |

| Precision Instruments (equipment for chip or LCD manufacturing, etc.) | Shock, Collision, Breakage, or Damaged Packaging |

Freight forwarder insurance covers various goods during the transportation process. Since most commodity trades involve transportation, goods may suffer losses due to natural disasters or unforeseen accidents. Freight forwarder insurance is an economic compensation measure for such losses.

Filing Claims for Damage, Loss, or Theft

To hold the carrier accountable, claims for damage, loss, or theft must be filed within a specified period. The shipper must file a compensation claim within two years for uninsured consigned goods transported by air or sea. For road transportation, the time limit is even shorter, only one year.

If the consigned goods are insured, the shipper must hold the carrier responsible and then contact the insurance company to file a claim. The time limit for filing a claim varies depending on the insurance policy. If the claim is approved, the insurance company will fully compensate based on the commercial invoice. If there is no commercial invoice, the amount is determined by market value.

The insurance company, in turn, seeks compensation from the carrier for the relevant expenses.

When Differences Arise

While carriers and customers typically navigate through challenges amicably, occasional conflicts may still emerge.

Verify all relevant documents, such as bills of lading and transportation agreements. These documents indicate the condition of the goods when the carrier received them.

If disagreements persist, seek assistance from an independent loss assessor. Carriers typically take this step to address disputes.

Balancing Costs and Benefits

Insurance is worthwhile because the value of consigned goods is rarely lower than the carrier or freight agent's liability amount.

Some factors may fall outside the scope of responsibility, so remember the principles behind insurance when deciding if your goods need freight forwarder insurance. Insurance provides coverage for relatively infrequent but widespread losses.

If your goods exceed the liability amount of the carrier or freight agent, or if you are shipping to an unfamiliar destination lacking well-established infrastructure, seriously consider the additional cost of taking on relatively low freight forwarder insurance.

Categories of Freight Forwarder Insurance

Freight Insurance Products | International Transportation | Maritime Transportation | Marine Cargo Insurance (All Risks/With Average/Free of Particular Average) |

| Institute Cargo Clauses (ICC-A/B/C) | |||

| Air Transportation | Air Cargo Insurance | ||

| Institute Cargo Clauses (ICC-AIR) | |||

| Land Transportation | Land Cargo Insurance (All Risks/Inland Insurance) | ||

| Domestic Transportation | Waterway, Road, and Railway Transportation | Domestic Waterway and Land Cargo Insurance (Comprehensive/Basic) | |

| Air Transportation | Domestic Air Cargo Insurance | ||

| Specialized Goods | Refrigerated Goods | Marine Refrigerated Cargo Insurance | |

| Road Transportation Refrigerated Cargo Insurance | |||

| Bulk Liquid Commodities | Association Transportation Bulk Liquid Cargo Insurance | ||

| Parcel Post Transportation | Parcel Post Insurance | ||

| Air Luggage | Domestic Air Passenger Luggage Insurance |

Underwriting Evaluation

Different modes of transportation correspond to different terms of freight forwarder insurance, ensuring coverage for specific risks associated with each mode. Are the underwriting coefficients the same for all goods regarding insurance coverage by insurance companies? Let's take a look at the choices insurance companies make when underwriting different goods:

| Policy | Customer Types | Types of Goods | Mode of Transportation | Region/Route | Insurance Products |

| Encourage Underwriting | Manufacturing and Trading Clients | Common Goods (Approximately 80% of All Cargo Types) | 1. Bulk Cargo (such as coal, ore, steel, soybeans, fertilizer, finished oil, chemicals, etc.) 2. Containerized General Cargo Transport | 1. Domestic Transportation 2. International Transportation: Routes to Asia, Europe, North America, and Australia | Nearly all cargo insurance products |

| Standard Underwriting | Large to Medium-sized Logistics Companies | 1. Fragile items such as glass, ceramics, and marble 2. Used equipment, second-hand goods 3. Hazardous materials that are flammable or explosive 4. Refrigerated goods 5. Electronically consumable products prone to theft | 1. Deck Cargo Transport of Large Items 2. Heavy Machinery/Equipment 3. Bare/Unpackaged Goods | International Transportation: Routes to Central and South America, Africa, terminating at seaports/airports. | / |

| Prudent Underwriting | Small-scale Logistics Companies | 1. Handicrafts 2. Fishmeal, pharmaceuticals 3. Motor vehicles, aircraft, weapons, and ammunition 4. Rare and valuable furniture like rosewood 5. Live animals, fresh plants 6. Precision equipment or instruments | 1. Bulk Cargo: High Moisture Content, Easily Liquefiable Ores (such as nickel ore, kaolin) 2. Bulk Transport of Liquid Plant and Animal Oils | 1. Domestic Transportation: Routes to Xinjiang and Tibet 2. International Transportation: Routes to sanctioned countries (Iran, North Korea, Syria, Congo) | Motor Carrier Liability Insurance |

Jike Logistics - A reliable freight forwarder in China you can work with.

For transportation companies, the risks of goods transportation exist, and the probability of occurrence is not low. Whether by land, sea, or international transport, Jike has a flexible risk-management system to minimize shipping risks and obtain economic compensation after the occurrence of risks.

Choosing JIKE as your freight agent is a smart move. JIKE offers efficient cargo transportation and comprehensive insurance coverage, safeguarding your interests during transit. Committed to addressing issues, JIKE ensures the secure delivery of your goods. With additional freight forwarder insurance, JIKE provides extra security.

Jike Logistics will take good care of your goods from the beginning to the end.

Related Articles

View all articles

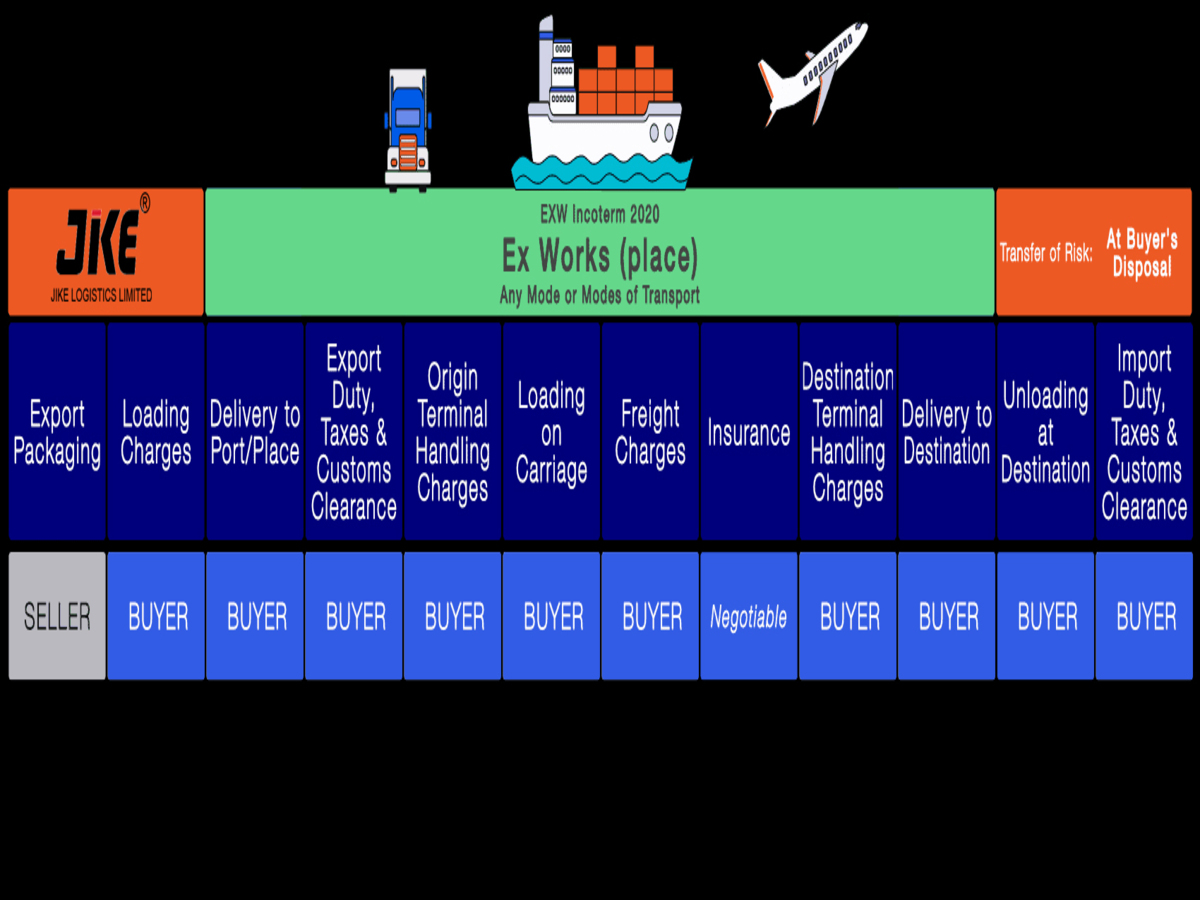

What does EXW (Ex Works) mean - Meaning, Usage & FAQs

This article provides a comprehensive overview of 'Ex Works', including its definition, when to use it, and practical considerations for both buyers and sellers.

25 August 2023

Shipping Service for Importing lithium batteries from China

We launches special shipping service for importing lithium batteries from China to Australia. We can handle all kinds of batteries from China to Australia.

07 July 2023

Consult Our Experts